Functional Beverages - Flowing into the Mainstream

- Lily Temperton

- Sep 22

- 5 min read

Updated: 5 days ago

The first in our Future Formats series, tracking innovation in functional products from beverages to vapes and beyond.

Each edition will spotlight emerging trends, category disruptors, and the product innovations reshaping consumer choices.

Fueled by the broader wellness movement, the functional beverage market is rapidly growing as consumers seek healthier, performance-driven alternatives to traditional soft drinks and alcohol. Tired of hangovers, excess calories, sugar, artificial additives, and the jitters from high caffeine, consumers are increasingly seeking "better-for-you" alternatives.

This demand has led to a rise in functional drinks that go beyond hydration, incorporating ingredients for targeted benefits like improved focus, relaxation, immunity, sustained energy, and digestive support.

The UK functional beverage market expanded by over 30% in 2024, compared to just 2–3% growth in the traditional soft drinks category (Brake, 2024). The U.S. functional beverage market, valued at USD 50 billion, is projected to reach USD 62 billion by 2027 at a 4.5% CAGR, driven by consumer demand for adaptogen-based and energy-boosting drinks (Glanbia Nutritionals, 2024). Globally, the market stood at USD 168.3 billion in 2025 and is projected to reach USD 296.7 billion by 2034 (Precedence Research, 2025).

Drinks With a Purpose

Purpose/effect-based drinks span a spectrum. At one end are purely recreational drinks like alcoholic beverages. At the other are health-focused options such as probiotics and fermented drinks. In between lies the category of functional beverages, designed for specific benefits such as energy, focus, mood enhancement, and stress relief. These can offer both enjoyment and wellness advantages.

Within functional beverages, two segments stand out:

The wellness drinks market, targeting both brain and physical benefits.

The No/Lo alcohol market, undergoing a significant transformation as consumers seek alternatives that provide relaxation and social connection.

Historically, No/Lo alcohol options were uninspired; low-alcohol replicas of beer and wine, or sugary mocktails. Perceptions of poor value drove many consumers to soft drinks or water instead. This is now changing as challenger brands like Collider and Impossibrew develop formulations using L-Theanine, ashwagandha, and functional mushrooms to recreate alcohol’s relaxing effects.

The scale of the opportunity is vast: the global No/Lo beer market is projected to grow from USD 19.5 billion in 2023 to USD 33 billion by 2030 (Brewers Journal, 2024).

From Hydration to High-Function

Beyond alcohol alternatives, functional drinks target a wide range of needs: boosting mood, focus, energy, and performance, or supporting stress relief, relaxation, and recovery.

By 2025, consumer priorities for functional beverages have both solidified and broadened.

Gut health continues to dominate as a leading functional need. In the U.S., gut health sodas Olipop and Poppi reached $817m in combined sales in 2025, with PepsiCo’s $1.95b acquisition of Poppi cementing the segment’s mainstream status (AP News, 2025).

Mental & emotional wellbeing has become firmly established, with mood and focus benefits now a mainstream driver (Innova Market Insights, 2025).

Immunity remains critical, with 32% of global consumers actively seeking immune support (ADM Global Survey, 2025).

Ingredient quality and transparency are increasingly non-negotiable, with 58% of consumers citing them as key purchase factors (WholeFoods, 2024).

Holistic wellness goals such as heart health, digestion, and healthy aging continue to resonate, with half of U.S. consumers linking gut health to energy, mood, and immunity (IFIC, 2025).

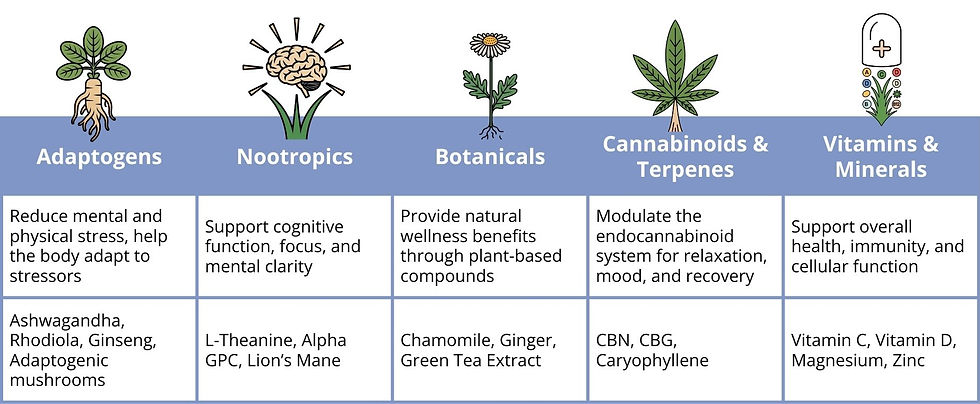

The Ingredient Toolbox

A broad range of functional ingredients address these needs:

These ingredients tend to fall under five main categories:

CBD in the Mix: From Standalone Star to Functional Team Player

CBD has long been positioned as a wellness ingredient, but its role in beverages has been inconsistent. Regulatory hurdles and consumer scepticism slowed adoption. Yet early enthusiasm for brands like TRIP helped reshape the category.

TRIP became the UK’s fastest-growing soft drink brand in 2023, with sales up 522% to £4.3m. By 2024, it had raised £10m in funding and achieved £20m in sales (The Times, 2024). In 2024, it launched Mindful Blends, combining CBD with ashwagandha, lion’s mane, and magnesium to bridge wellness and No/Lo alcohol. TRIP is forecast to reach USD 100m in 2025 revenue, supported by viral engagement exceeding 3.5 billion TikTok searches (Vogue Business, 2025).

CBD beverages as a whole accounted for 47% of functional soft drink growth in the UK, adding £7.4m in sales. The UK CBD beverage market hit £11m in 2022 (The Grocer, 2023). Globally, the CBD market is projected to reach USD 22–25 billion in 2025 (HeikoCBD, 2025).

Other players such as Simplee and Common are now combining CBD with adaptogens and nootropics to deliver more multi-functional benefits.

No/Lo Alcohol Rises: Reinventing Social Drinking

Alongside wellness-driven consumption, alcohol alternatives are surging. Consumers increasingly want the social relaxation of alcohol without intoxication, driving innovation in alcohol-free beer, spirits, and mood-enhancing drinks.

Key behaviour shifts include “Zebra Striping”, where consumers alternate between alcoholic and non-alcoholic drinks to avoid hangovers. Gen Z is at the forefront, favouring functional beverages over traditional soft drinks and alcohol.

Market momentum is strong:

The UK No/Lo market reached £380m in 2024, growing 47% YoY (Brewers Journal, 2024).

The European market was €8.6b in 2023, projected to reach €15.4b by 2032 (Stellar Market Research, 2024).

Global non-alcoholic beer grew 9% in 2024, to USD 13.7b, and is on track to surpass ale as the world’s second-largest beer category by 2025 (Food & Wine, 2025).

Consumer trends indicate:

77% of UK adults are moderating alcohol intake.

1 in 3 UK pub visits are now alcohol-free.

In Germany and Spain, alcohol-free beer exceeds 10% of total sales (Euromonitor, 2024).

Bars and retailers are responding: four in five UK bars plan to expand No/Lo options, and No/Lo drinks now account for 11% of all new alcohol launches in Europe, growing five times faster than traditional products.

A Natural Fit? The Role of Cannabis as an Alcohol Alternative

Cannabinoids align naturally with the No/Lo trend. CBD offers stress-relieving and mood-balancing properties, while CBN and terpenes such as limonene, myrcene, and pinene provide targeted benefits.

The THC beverage market is also growing rapidly in legal markets, fuelled in the U.S. by the 2018 Farm Bill’s legalisation of hemp-derived products with <0.3% THC. By 2023, the broader hemp-derived cannabinoid market exceeded USD 21b. The U.S. cannabis beverage market, valued at USD 1.16b in 2023, is projected to grow at 19.2% CAGR through 2030. Globally, cannabis beverages hit USD 2.04b in 2023 and are expected to reach USD 117b by 2032 (Fortune Business Insights, 2024).

THC beverages bridge two major shifts: rising cannabis consumption and declining alcohol use. Low-dose formats are emerging as mainstream alcohol alternatives, accelerated by state-level legalisation and distribution in retail and convenience channels.

Beyond CBD and THC, other cannabinoids and terpenes are being explored. CBN is positioned for sleep; limonene supports uplift, myrcene promotes relaxation, pinene aids focus, and caryophyllene supports mood regulation.

From Trend to Mainstream

The functional beverage sector is poised for rapid expansion, but so are consumer expectations. To succeed, brands will need to:

Prove functionality with credible science and communicate it clearly

Keep formulations clean, low in sugar, and transparently labelled

Demonstrate sustainability

Deliver taste and texture that encourage repeat purchase

Ensure accessibility through affordable pricing and broad distribution in mainstream channels

Integrate seamlessly into consumer lifestyles, from pre-workout routines to social occasions

Build cultural resonance through strong branding, authentic storytelling, and alignment with wellness and sober-curious communities

Comments